It is finally that time of the year that most companies release their financial statements for the quarter! In the best fashion, this blog post will be summarizing the highlights from the release on this past Wednesday, October 30th.

First, the company’s earnings per share ratio ended the year with $0.67. Compared to previous years, this is a 20% increase, which is always good for a company.

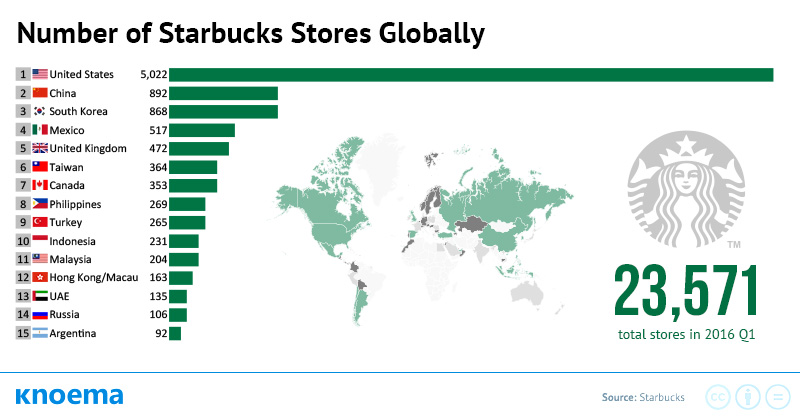

Looking purely at findings from the Q4 highlights, the company focused on expanding the franchise on an international level. Global sales rose around 5%, which is significant considering the immensity of the company. They also opened a large amount of stores in other countries over the course of the last quarter. A final highlight from the report on the fourth fiscal quarter was the fact that $2.7 billion was returned to the shareholders during this time frame.

In comparison to Q4, the full fiscal year highlights do not have such a positive push on them. On one hand, the consolidated net revenues showed some growth, about 7% to be exact, and this growth helped the company survive the past year. On a sadder note, the Earnings Per Share price of the market decreased, which is not always the most beneficial scenario.

The report also featured goals for 2020. The company wishes to continue expanding the group internationally, continuing this initiative. There were also large margins of growth, about 8% for both consolidated net revenue for the entire year and consolidated operating income revenue.

Looking at these findings to the company, the paper also focused on company updates that have been discovered in the past year. Some of these updates were described in previous blog posts. One interesting story, however, was a three-day conference called the Leadership Experience for store managers. This helped strengthen the credibility and professionalism of all Starbucks locations. Additionally, the company left 29.2 million shares available on the market for purchase after repurchasing 23.5 million shares of financial stock.

Speaking of stock, here are the statistics for the past week:

After a short period of growth, the stock has once again dropped for the company. According to this graphic, however, it appears as if the stock is positioned in blocks of each day rather than one continuous peak over the last week, which I think is an interesting pattern. Overnight trends must have contributed to these changes that occurred, such as the drop in the stock on Wednesday morning compared to the night before.

Before I leave for the week after discussing the release of such important financial information, I am recommending a hot chocolate this week as my beverage of the week! After volunteering at Special Olympics, I found myself heavily in need of a warm beverage, but I did not need to rely on caffeine with each sip. I recommend this drink because it is a nice transition between Halloween and the Thanksgiving/Christmas season. I hope you enjoy this drink, and I look forward to writing again next week!

For more information on the financial report, visit the Starbucks website or click here for more information!

nice summary of the financial results; seems like Starbucks is doing OK. Happy to hear you were a volunteer at Special Olympics. By the way, doesn’t hot chocolate have caffeine?

LikeLike